Hallo all happy to have the opportunity to share, in this new post I will introduce about the project SymmetryFund. and for that let's go to the following discussion:

The Symmetry Fund has been designed to make it easier for individuals to invest in crypto without all the business, capital and risks associated with private trading in the market.

The graph below explains how the flow of information in SYMM will be structured.

There has been a rise in the price of crypto in recent years and analysts are seeing further increases in the medium to long term. While the famous Bitcoin, Ethereum is another cryptocurrency that attracts a lot of investor interest because of its potential in infrastructure applications using Blockchain technology.

SYMM funds are investing in Bitcoin, Ethereal, Dash, Lite Coin and Ripple so as to offer a diversified portfolio for those seeking the security of traditional mutual funds, yet still benefit from the increase in the cardinal cardigan market, especially the lucrative ICO. (Initial Coins Offer). As part of Ethereal Blockchain, the fund pays a monthly dividend equivalent to 50% of trading profits in the ETH with the remaining 50% reinvested, with voting once every three months. However, unique to the kriptocurrency market, investors in SYMM funds have a choice of buyback options.

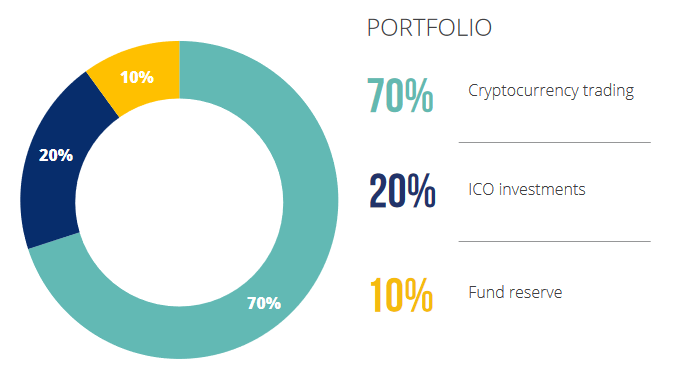

Fund managers have stated that high levels of transparency on profit / loss and dividends will be maintained through daily reporting to investors, while a reserve fund of 10% will remain in flat currency (US $ / €) to reduce risk on the Blockchain market. unstable

Each share is offered as a SYMM token, which can be traded at market price, enabling the holder to withdraw at any time. The initial ICO will last for 60 days when the token will be offered at a starting value of 0.1 ETH (payable only in Ethereal), prior to commencing trading. While those funds are not available to US investors, the management fee is competitive and is subject to a 7.5% fee for investments in excess of 100 ET and 15% for under 100 ET.

About SYMM

SYMM's investment fund is managed by some of the most experienced investment managers in the world, including Andrew Lewin, senior fund manager at Credit Suisse, FX strategist David Steiner and Markus Kohn, a technical architecture expert.

ICO

At the pre-ICO stage, pre-sale sales and public sales, there will be no discounts available.

The price for 1 SYMM is 0.1 ETH. SYMM has two available stock classes:

For an investment of more than 100 ETH, SYMM shares will have a management cost of 7.5%. (Class A)

For investments under 100 ETH, SYMM shares will have a 15% management fee. (Class B) Holding> 1000 shares of SYMM will automatically get 7.5% management fee.

Holding <1000 shares of SYMM will get 15% management fee

New coins are usually listed on the stock and sufficient liquidity in 1 to 3 months. Investors will have a buyback option during this period, or until SYMM is listed on one of the largest exchanges.

Summary of ICO SYMM

One SYMM share equals one ERC-20 compliant token.

The ICO duration is 60 days from 30 November 2017 to 30 January 2018 ..

During ICO, 1 SYMM share will be charged at 0.1 ETH.

ICO Soft Cap is 3,000 ETH.

No Hard Cap for ICO.

Trading in BTC, LTC, DASH, ET and XRP will be made using 70% of the fund's capital.

20% of the funds will invest in potentially high ICO. SYMM will secure deep discounts (up to 50%)

ICO which has not been released for public sale.

10% of the funds will be held by the funds in the reserve to ensure that the entire fund is never exposed at all times.

50% monthly trading profit will be paid dividends to investors every month. Dividends will be paid in ET.

50% monthly trading profit will be held for compounding growth.

To reduce risk and ensure the stability of the value of funds, SYMM funds will be held in USD and EUR.

Risk mitigation strategies will be undertaken.

Management fees will not be charged if there is no profit.

Under the scenario of symmetry and projected funds, the estimated annual ROI for the SYMM investor is estimated at more than 50%.

All shareholders will have the opportunity to vote on major fund decisions, which further encourage trust and sparency between the fund and its shareholders.

All transactions performed by SYMM will be specified in the relevant exchanges.

Funds held by SYMM will be subject to an external audit each month.

The balance of the account and the value of the SYMM funds will be reported to the stockholders on a daily basis.

Until SYMM is listed on the main exchange, all shareholders will have the ability to sell their investments for instant liquidity

Trading Phase

After ICO successfully closed and funds withdrawn from ICO, the trading phase will begin. The trading phase will continue indefinitely with changes in trading activities such as traded pairs and the allocation of funds may be selected by shareholders.

At the start of trading phase, the value of SYMM capital will be from 90% of capital in ICO. This capital will be converted into fiat currency and quoted in USD.

OUR TEAM

ADVISOR

Dividend

When SYMM generates a monthly profit, dividends will be paid to shareholders in ETH through smart contracts on day 3 of each month. Dividends will soon be available to SYMM investors when payment is sent to the dividend contract. Investors can then withdraw funds when they choose.

Summary of ICO SYMM

- One SYMM share equals one ERC-20 compliant token.

- The ICO duration is 60 days from 30 November 2017 to 30 January 2018 ..

- During ICO, 1 SYMM share will be charged at 0.1 ETH.

- ICO Soft Cap is 3,000 ETH.

- No Hard Cap for ICO.

- Trading in BTC, LTC, DASH, ET and XRP will be made using 70% of the fund's capital.

- 20% of the funds will invest in potentially high ICO. SYMM will secure deep discounts (up to 50%)

- ICO which has not been released for public sale.

- 10% of the funds will be held by the funds in the reserve to ensure that the fund is never exposed at all times.

- 50% monthly trading profit will be paid dividends to investors every month. Dividends will be paid in ET.

- 50% monthly trading profit will be held for compounding growth.

- To reduce risk and ensure the stability of the value of funds, SYMM funds will be held in USD and EUR.

- Risk mitigation strategies will be undertaken.

- Management fees will not be charged if there is no profit.

- Under the scenario of symmetry and projected funds, the estimated annual ROI for the SYMM investor is estimated at more than 50%.

- All shareholders will have the opportunity to vote on a major funding decision, which further encourages the trust and sparency between the fund and its shareholders.

- All transactions performed by SYMM will be specified in the relevant exchanges.

- Funds held by SYMM will be subject to an external audit each month.

- The balance of the account and the value of the SYMM funds will be reported to the stockholders on a daily basis.

- Until SYMM is listed on the main exchange, all shareholders will have the ability to sell their investments for instant liquidity.

For more details and join the current Symmetry Fund project please follow some of the following links:

Website: https: //symmetry.fund/

Ann Bitcointalk: https: //bitcointalk.org/index.php? Topic = 2480514.0

Twitter: http: //twitter.com/symmetryfund

Github: http: //github.com/symmetryfund

My Bitcointalk (Arumi.Bilqis) : https://bitcointalk.org/index.php?action=profile;u=965668

My ETH Address : 0x78A118ED0556B119ccafe86089a292A048234E79

Tidak ada komentar:

Posting Komentar