On the "Epic / Awesome / Cool" spectrum of crypto companies entering the pass, entertainment sub-sectors such as gambling and rankings are quite high. However, on the other hand, you will find the compliance of Anti Money Laundering and Combating Terrorism (AML / KKP) regulations. While that may be true, you would be hard pressed to make the argument that AML / CTF as a service is not a critical component in crypto.

To get a better understanding of what is AML / CTF, I suggest we look at why anyone is looking for a servicer. The latest news that Humaniq and Coinfirm have partnered is a perfect example of where their two missions are aligned. Humaniq will benefit from increased security, protect transactions with genuine HMQ signatures from uncontrolled use, and Coinfirm will fulfill their mission to make the global financial system safer, transparent, effective and accessible for new economies and individuals. In other words, the AML / KKP Coinfirm solution gives legitimacy to their digital currency and equals other asset classes.

Think about it. The AML / CTF Coinfirm solution is perfect for any entity that has the need to deliver give a high level of trust. Regardless of the sector of a crypto pass of an entity, they do not want to expose themselves, their clients, and their partners to take risks. In other words, any entity that touches cryptocurrencies or operates with them needs to apply the AML / CTF compliance rules to protect themselves and enable its commercial growth. The cryptocurrency pass can be applied to some kiss of the economy and the entity operating within it will require AML / CTF compliance for legal, commercial, moral reasons.

The AMLT Coinfirm compliance mark is a solution that can bring transparency and democratization to the system by actively involving the offender in determining risk. Furthermore, the AMLT token will also trigger transactions on the Coinfirm platform, enabling risk management and creating a network for safe and transparent exchange of values.

On the "Epic / Awesome / Cool" spectrum of the crypto corporation passing through, entertainment sub-sectors such as gambling and rankings are quite high. However, on the other hand, you will find Anti Money Laundering and Counter-Terrorism (AML / KKP) rules. While that may be true, you will keep that as AML / KKP meant as an important service in crypto.

As reported and leaders have shown, Regulatory Compliance, especially Anti Money Laundering (AML) and Counter Terrorist Financing (CTF) for Blockchain and virtual currencies have been massive roadblocks to their overall mass adoption.

AMLT provides access to secure and transparent blockchain economy - it protects you, your partners and clients from potential risks and allows for commercial adoption and growth.

MARKET CHALLENGES & SOLUTIONS

All markets are at risk when forbidden activity is left uncontrolled. Notes in their whitepapers are traditional AML enforcement failing 99.9% of the time and less than 1% of the forbidden global financial flows are confiscated and. Prevention and control mechanisms are very important for companies that want to make sure they are not consciously or unconsciously exposed, partying, or full.

However, blockchain technology enables democratic participation and provides an opportunity for everyone to provide input and participation. Thus, it is possible to be more accurate, effective, and less arbitrary than traditional systems. Therefore, not only have more transparency and efficiency as well. The market is cheaper and more.

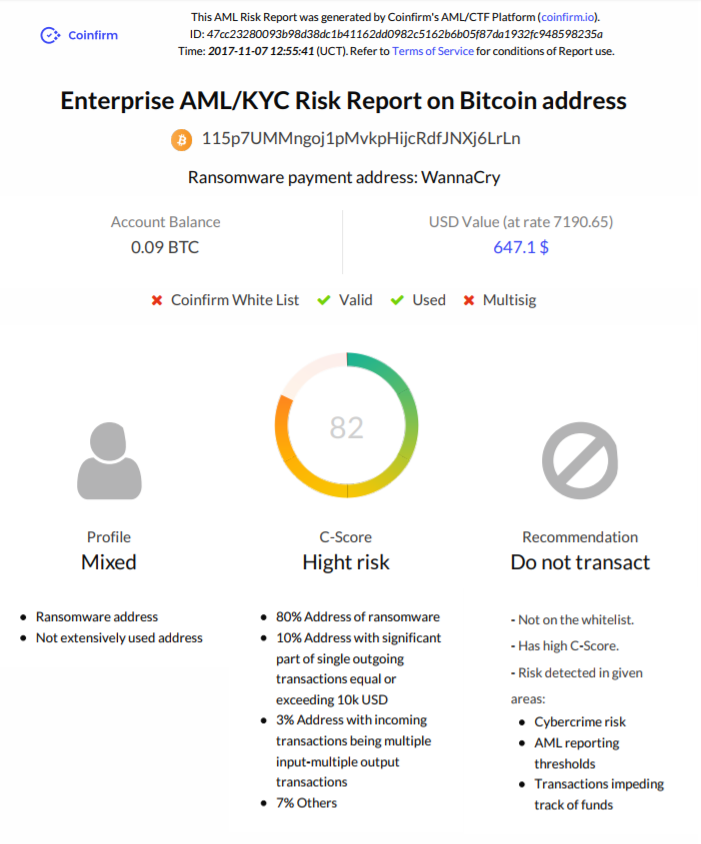

Coinfirm's mission is to provide an efficient and effective global standard for AML / CTF compliance in a decentralized and democratic manner in which participants can rank AML / KKP / Fraud / business / risk (see example Risk Report below):

In addition, Coinfirm expects that their AML / CTF platform serves as a bridge to accommodate new business models and adopt the blockchain and virtual currency.

The AML / CTF Coinfirm platform currently serves three major obstacles as well as the ERC20 and ERC233 tokens:

Bitcoin (BTC)

Dash (DASH)

Ethics (ETH)

The platform can support the majority of public and private blockchains and can be integrated within three days.

The table below describes technical metrics

METRICSDATAQuery Queries100 reports per secondSize Data Sets3TB SQL tables, 500GB graph data, 250GB raw blockchainNumber of Scenarios Rating186Average Time to Generate Reports10s

ICO DISTRIBUTION DETAILS

ICO Terms & Conditions

TOKEN: AMLT

CIRCULATION: 210,000,000 in ICO

TOTAL CIRCULATION: 400,000,000

TOKEN TYPE: ERC 20

CURRENCY ACCEPTED: ETH

ICO DURATION: 28 November - 31 December, 2017

ROADMAP

MILESTONEMAKNAPra-1.0 AMLTThe Coinfirm AML / CTF Platform provides secure solution for virtual currency ecosystem 1.1.0 AMLTAMLT redeemable with AML Risk Reports with AMLT AMLT big discount2.0 integrated with Platform. Users who through the identification and verification process can exchange information to participate in AMLT Daily Distribution.

TOKEN SALE

Token sale: 210,000,000 Available in crowdsale

Data rewards pool for network members: 120,000,000 Distributed monthly through the existence of smart contract

Founding Team: 10% With lockup period

Advisors: 2%

Rewards for referrals: 1%

Dev team and bonuses: 4% With lockup period

Charity: 0.50%

Total Tokens to be generated in smart contract: 400,000,000

TIME LINE

TEAM

Coin fi rm's team consists of professionals and entrepreneurs with vast business and compliance experience, supported by great tech and blockchain specialists.

Founders

• Pawel Kuskowski: Co-Founder and CEO

An entrepreneur, recognized AML / CTF and compliance advisor; former head of global AML / CTF processes at major financial institutions such as RBS; a specialist in compliance and anti-money-laundering with extensive experience conducting global projects for international financial institutions and cooperating with supervisory authorities; the chairman of the Compliance Association of Poland.

• Pawel Alexander: Co-Founder and CIO

One of the more recognizable fraud prevention experts in Central Europe, former Head of Fraud Investigations in ArcelorMittal, AML / CTF Project Manager in the Royal Bank of Scotland, fraud investigator and auditor in Ernst & Young; holds the titles of Certified Fraud Examiner and Certified Internal Auditor.

• Grant Blaisdell: Co-Founder and CMO

California and European startup ecosystems; whether through his own projects or working with major companies.

• Jakub Fijol ek: Co-Founder and CTO

An innovative IT and security specialist, has been analyzing and developing around blockchain, cryptocurrencies and their applications since 2010; the former head of multi-algorithm virtual currency mining farms.

• Maciej Zi'o lkowski: Co-Founder

An international pioneering virtual currency adopter, involved in the Bitcoin and Blockchain space since the early stages; a reputable author and speaker on the subject and co-founder of the first Bitcoin establishment of its kind in Europe.

Details Information

Website: https://amlt.coinfirm.io/

Whitepaper: https://amlt.coinfirm.io/pdf/white-paper.pdf

Facebook: https://www.facebook.com/AMLToken/

Twitter : https://twitter.com/AMLT_Token

Telegram: https://t.me/AMLT_Coinfirm

My Bitcointalk (Arumi.Bilqis) : https://bitcointalk.org/index.php?action=profile;u=965668

My ETH Address : 0x78A118ED0556B119ccafe86089a292A048234E79

Tidak ada komentar:

Posting Komentar