Envion is part of the evolution of the next generation of mining companies using a variety of new and innovative techniques to become more reliable, cost-effective, scalable, and most important: profitable.

ENVION VISION & VALUE PROPOSITION.

Envion wants to be a major innovator in the cryptococcal mining sector while engaging Envion token holders to make strategic mining decisions by voting. The environment understands that to be successful they need modular, mobile, flexible, low maintenance, data-based solutions.

Envion plans to execute their vision through three (3) technologies:

1.Decentralized Cellular Mining Unit (MMU). Envion will create and use standard 20ft delivery containers, called MMUs, into home mining rigs. This MMU will be placed in different locations to form a decentralized network. In this model, if one or more nodes in the network are temporarily offline, the entire network still persists and the operation is only degraded and not completely offline.

2.MMU will be equipped with a self-regulating, highly efficient, and unsafe patent-pending cooling system. The Envion cooling system will only consume about 1% of the total energy consumption of the system. The MMU configuration is detailed in the "MMU Configuration" section.

Unified Mining Cloud (UMC). Envion will manage their MMU through UMC which will combine data and control and optimize MMU operations.

3.Global Smart Energy Sourcing (SES). The location of the energy source will play a key role in the success of Envion's vision, but many factors (eg pricing structures for industrial users, feeding tariffs for renewable energy, on-site consumption discounts, grid fees, taxes, levies and exemptions) require consideration. The environment has developed an exclusive multidimensional system to help identify the most efficient locations for data processing and crypto blindness.

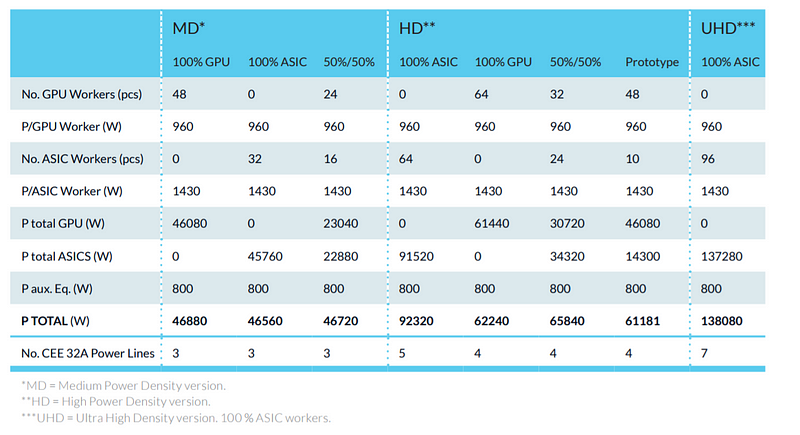

MMU can be built using ordinary ASIC mining or with Envion's GPU-based rig configuration that allows 100% or 50% / 50% deployment.

Environ's air cooling system enables "medium density" (<50 KW), "high density" (60-85 KW) and ultra high density (137 KW; ASIC-only) configurations. Implementation of a moderate density MMU version will allow deployment to areas with exceptionally high air temperatures.

This configuration is illustrated in the table and picture below:

ADDITIONAL OPERATIONAL AREA.

For those of you who are familiar with my reviews, I am deliberately passing a business area that I think should be given. Envion needs to describe and boast about this area but I do not feel I have to do it.

Thus, the following areas are described in detail in the Envion whitepaper, but are passed in my review:

Security (physical MMU, software, network, etc.)

Hardware Optimization

Remote Monitoring & Maintenance

Company structure

ICO DISTRIBUTION DETAILS.

TOKEN: EVN

CIRCULATION: TBD in ICO

TOTAL CIRCULATION: 150,000,000

TOKEN TYPE: ERC20

CURRENCY ACCEPTED: BTC, ETH, credit card

LIMITATIONS?: United States and Swiss investors

STAGE ICO - BONUS - AND TOKEN PRICE

STAGE 1: 12 PM GMT DEC 1-2 - 30% - $ 0.70 USD

STAGE 2: 12 PM GMT December 3-7 - 20% - $ 0.80 USD

STAGE 2: 12 PM GMT DEC 8-15 - 10% - $ 090 USD

STAGE 2: 12 PM GMT DEC 16-3 - 10% - $ 1.00 USD

BUSINESS AREA - PERCENT.

Investment in Mobile Mining Unites (MMUs) - 91%.

Research & Development and Administration, General Reserves, Legal Proceedings for Status of Tokens as Publicly Available Security - 9%.

If ICO increases by less than $ 7 million, the gradual use of funds will shift from MMU investments to administration and marketing. In this case, Envion will focus on third-party business to maintain profitability for investors and provide ROI.

EVN TOKEN HOLDER HOLDER & BENEFITS.

EVN holders are eligible to receive three (3) types of benefits:

Ownership Operations (PO): Net mining profits * (Mining benefits less operating costs (eg electricity, land rent / lease, hardware upgrades & repairs)) will be distributed as follows:

75% will be shared with the token holder.

25% will be reinvested to grow Envion to increase future distribution payments.

Net profit margin is not the same as the entire income statement / loss of Envion.

2. Third Party Operations (TPOs): 35% of mining revenues from business cases where independent companies such as utilities acquire MMUs while Envion operates them.

3. Voting Rights: Sometimes, Envion needs to make strategic decisions regarding mining operations. In such cases, Envion will bring the proposal to a vote using the token intelligent contract capability.

MIND FINAL.

Mining can be very profitable, but it is a challenging environment that requires industry-level monitoring, planning and flexibility when something is changing. Do not forget that the profitability of cryptocurrency can also change, or in the case of Ethereal, change from Proof-of-Work (PoW) to Proof-of-Stake mining (PoS). I think Envion has all the components to meet that challenge.

I feel that I have discussed Envion's primary value proposition, but I encourage those who are considering investing in Envion to read their whitepapers for more details.

Envion is the second mining company that uses shipping containers, so I think the idea becomes an industry standard. Another company that I reviewed with the same idea of Hydrominer.

While decentralized networks are optimal, I would like a little more information about the cost of moving the node. Moving shipping containers requires-you guessed it-energy consumption. The two companies, not estimating how many times they think they should move, nor do they estimate how much the cost or impact will come true as it happens. It is also not clear whether Envion considers the cost to move a node as a mining operation cost or a company's overall loss. This may be the cost of mining but I do not want to assume. In my mind, all crypto mining companies are concerned with the cost of doing mining operations, so the fact that Envion assumes there is a better difference for EVN marker holders but surprises me a bit.

Envion is alluring. 75% of net mining profits, plus 35% of third-party profits distributed every week are the best deal I'm aware of. On their main site page, Envion estimates an annual ROI of 161%, but who knows. There are a number of factors that may affect those estimates. Of course, that does not mean howling if Envion can not achieve a decent profit margin, but from reading Envion's notebook sheets, they clearly have detailed plans for the operation. I think it alone increases my level of confidence in their survival. Lastly, I love the Envion plan to reinvest 25% of net income to accelerate growth (and future distribution). This is something I'm sure long-term holders will love to see.

Overall, I love the Envion changes for long-term survivability and assume readers should regard Envion as a candidate for some potential ROI.

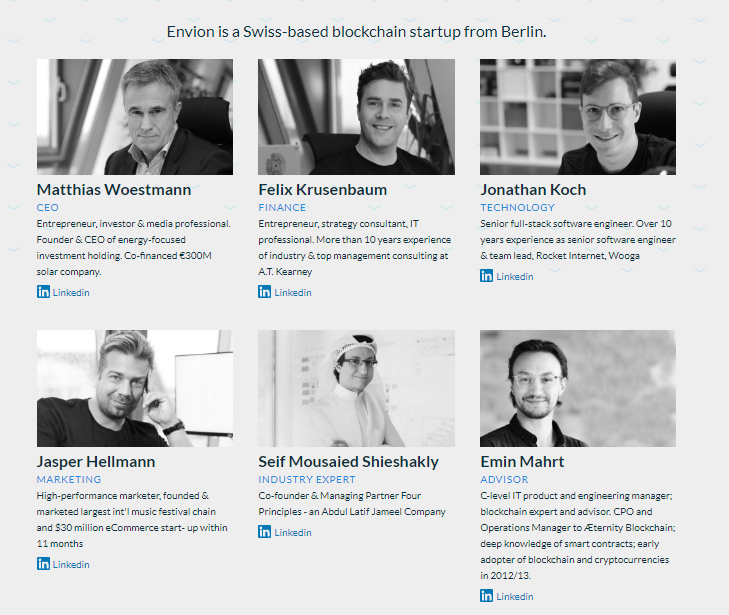

Team

The Swiss-based platform and professional team is led by CEO, Matthias Woestmann. The first mining unit was launched in 2015 and the company began mining in all environments this year. Envion plans on listing on exchanges in the future, and have planned the mass production of the mobile units for next year.

The platform seems to provide a complete solution to the crisis crisis affecting the crypto industry and blockchain technology as a whole. Offering sustainable, affordable and mobile energy sources will pave the way for an easy transition for global adoption of blockchain and all of its many benefits.

Further information:

Website: https://www.envion.org

Facebook: https://www.facebook.com/envion.org

Twitter: https://twitter.com/Envion_org

My Bitcointalk (Arumi.Bilqis) : https://bitcointalk.org/index.php?action=profile;u=965668

My ETH Address : 0x78A118ED0556B119ccafe86089a292A048234E79

Tidak ada komentar:

Posting Komentar