What is Ceyron?

Ceyron is a decentralized exchange system that wants to increase the liquidity of cryptographic assets more transparent and secure than the centralized counterparts currently on the market. Ceyron is an ecosystem built and operated by a network of popular partners around the world in a centralized network. The goal is to provide an appropriate financial experience worldwide by using the power of chain block technology. Ceyron has a simple and sustainable transaction-based business model. Every trader makes a profit from the transaction.

Identify the Problem

The problem Ceyron wants to solve is summarized below. According to this,

The banking level is low

The African economy is heavily liquidated and has a very bad financial footprint. Less than 10% of adults have bank accounts. The market returns with cash transactions. For example, more than 85% of trade is cash.

A very competitive market

The mobile money environment in Africa is becoming increasingly competitive. This increased competition means that consumers have more choices.

Very low usage rate

In Africa, 12% of account holders exist in the world. But the level of inclusion in the financial system is very low. The average behavior analysis of paying users resembles a general trend: withdrawals representing at least 60% of the volume of transactions; peer-to-peer transaction 20%; 10% call duration, 8% payment and 2% savings.

Ceyron Kart

The CEY Card will be a physical, virtual, and charged MasterCard with a mobile application that will allow the use of twenty (20) foreign currencies from a single card. In similar life style cards market, in addition to a transaction fee, most cards charge a percentage of the market rate of spread of foreign currency. Customers who travel with more than one currency to more than one country will inevitably enter the "Cash Toll Fee" and the "Currency Transaction Fee". These costs are mostly the process plus a flat rate, the sector's leading wages are 2.75% - 2.99%.

Ceyron Bank Card

Cards are provided with the CHIP feature and most contactless technology. What does it mean? CHIP (also known as EMV) is a technology that makes your bank card much safer and harder to copy or copy. With CHIP cards, confidential information is much safer than old-fashioned magnetic stripe technology and card issuers; for example, when you buy something, you are faster, more reliable and much safer. This technology has been standardized worldwide and your CHIP-enabled debit card can be used anywhere (when Mastercard is accepted) and is compatible.

Non-contact (formerly PayPass) is a card technology that allows quick payment of small personal purchases at stores by touching or waving cards to a card terminal. You do not need any PIN or signature to make a small purchase. There is protection against accidental or double payments. It replaces cash for contactless payouts.

Digipass Available

DIGIPASS Application in line with latest technological developments and customer preferences; enabling customers to securely verify their online card transactions using their smartphones.

The app can be downloaded from the official App Store and Google Play Store for all Android, IOS, and Windows smartphones; thus making online banking safer and much more convenient than before:

- Secure modern technology in your mobile device

- Easy to read QR code

- Additional security with fingerprint protection (on supported devices)

- No need to carry an extra device to activate online banking

- No lifetime limitation

- More flexibility for PIN management

- Manage more accounts with one app

- Ceyron Replacement

The core is based on the Graphene Block chain library, which is guaranteed to be proof of security, extremely efficient and secure, with a processing scale of more than 100,000 at the moment.

Ceyron uses the LMAX high-speed matchmaking engine based on the graphene program to achieve millions of process matching abilities at the moment. The nodes of the system will be efficient and secure blocking and packaging services through the DPOS consensus. In the future, increased scalability will come from the adoption of EOS. We believe that by introducing innovations to the protocol layer to facilitate easy and secure transactions, and by injecting the application layer and commercial and operational expertise to improve the user experience, it greatly enhances the adoption of decentralized shopping.

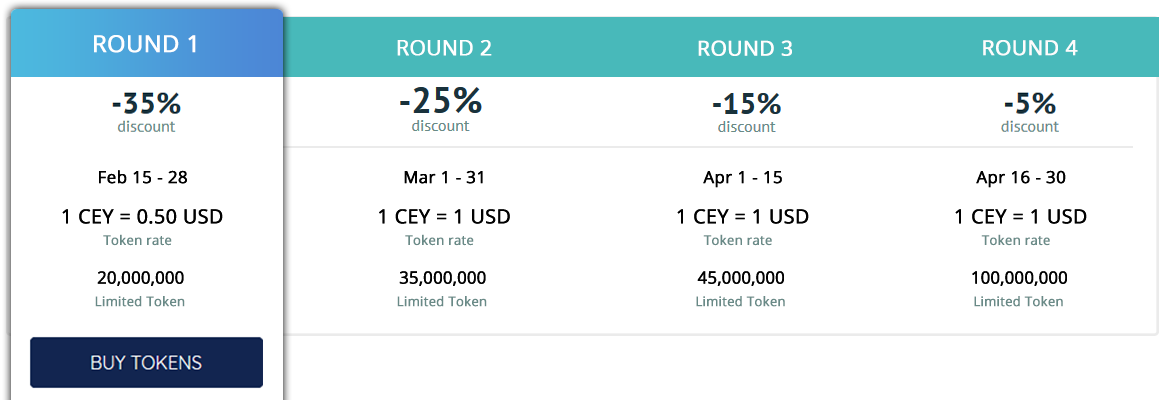

Ceyron (Cey) Token Sale and Distribution

CEI Symbols are functional intelligent contracts within the Fund. CEY Symbols are not returned. CEY Symbols are not for speculative investment. Future performance or value will not be promised or awarded in relation to CEI Documents, including no promises of natural value, no promises of continuing payments, and no guarantee that CEI Documents will be of particular value. CEY Rights are not securities and they do not join the Company. CEY Symbols are not entitled to any rights in the company.

CEI Shares are digital markers that will be given to the investor and represent beneficial ownership interests in a separate class of shares that are not voting rights in Ceyron. The legal title of the representatives will be kept confidential by the Loyal Agency & Trust Corp ("LATC" or "Candidate") for iconic owners and the marketer will have a useful interest in Ceyron Finance Ltd. is not included in the management or operation of the Fund or Fund Manager described below.

CEY Token - offers an intelligent contract digital sign that represents beneficial ownership in the non-voting shares of the CEY to be held by Loyal Agency & Trust Corp, which is trusted by the CEY Tokens' ownership.

Some Information;

- Token Name: Ceyron

- Token: CEY

- Price: USD 1.00 per CEY Token

- Number of Tokens For Sale: 250.000.000

- Pre-ICO Sales Start: 16.2.18

- Pre-ICO Ending: 15.3.18

- Pre-ICO Discount: 30%, 25%, 15%

- ICO Starts: 3/16/18

- Soft Cap: TBA

- Hard Cap: TBA

- Token Sales Result: When Hard Cap is reached

- Accepted Currencies: BTC, ETH, LTC and USD

Road map

1st Quarter 2011

Create a secure loan portfolio with the fund;

Expanding the plans and capabilities of the CEY Debit Card, integrating the strategic partner Debit Cards with the CEY Debit Card, and expanding local fiat debit card capabilities, including crypto-purses;

Hire integrated engineers to create crypto exchange and Bank Card features.

Launch of the CEY Debit Card Program, which the CEY plans to open approximately fifteen thousand (15,000) to twenty thousand (20,000) cards worldwide.

Quarter 2019

Complete the crypto exchange exchange and add cross-exchange trading capabilities, upgrade the markers listed on such stock exchanges to other ERC20 markers, and complete seamless integration of these exchange platforms into their debit cards.

Quarter 2020

Create decentralized applications to address complex banking needs, such as smart contracts, to facilitate payment of sales tax at point-of-sale terminals.

resources

For more information, please visit the links below :

Website: https://ceyron.io/

Technical Report: https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Facebook: https://www.facebook.com/Ceyron/

Linkedin: https://www.linkedin.com/in/haythem96/

Twitter: https://twitter.com/cryronico

Instegram: https://www.instagram.com/cryronico/

My Bitcointalk (Arumi.Bilqis): https://bitcointalk.org/index.php?action=profile;u=965668

ETH: 0x78A118ED0556B119ccafe86089a292A048234E79

Tidak ada komentar:

Posting Komentar